About Modern Chevrolet Of Winston Salem

Table of ContentsEverything about Modern Chevrolet Of Winston SalemThe Only Guide to Modern Chevrolet Of Winston SalemModern Chevrolet Of Winston Salem - TruthsTop Guidelines Of Modern Chevrolet Of Winston SalemOur Modern Chevrolet Of Winston Salem PDFsGetting My Modern Chevrolet Of Winston Salem To Work

A popular instance of supplier funding is auto suppliers that supply automobile acquisition funding. Car dealers market these finances to clients that may not otherwise qualify for financing since of a bad credit ranking or various other aspects.Several auto suppliers increase the finance business's rates of interest and keep the difference as added revenue. The so-called buy rate is the interest price that the monetary institution quotes to the supplier for the funding. The real rate of interest the dealership offers to the consumer, however, can be established more than what the buy rate is.

An automobile financing calculator can be made use of to identify what the real optimal rates of interest would be for a vehicle, based upon its rate. The dealership might possess the real financing instead of move it to various other parties. By supplying financings at the dealership, an automobile retailer may have the ability to safeguard the sale of a lorry much more easily than awaiting prospective buyers to arrange financing on their very own.

All about Modern Chevrolet Of Winston Salem

In some circumstances, suppliers that provide such financing to customers that might be thought about high-risk might additionally set up gadgets in the vehicle that will certainly disable it if repayments are not received promptly or to help in the searching for and repossession of the car if necessary. While it may be less costly for the client to protect their own car loan, dealer funding can minimize the time and effort it takes to do so.

A main site of the State of Georgia. Just how you understand

A supplier may tell you that you do not get approved for affordable prices. And while this might be true in some cases, the salesperson will suggest your credit history is worse than it is, so you assume you'll have to pay a higher rate of interest. How to stay clear of: Be available in with your credit history rating available prior to you take a seat with the dealership so they can not trick you.

Modern Chevrolet Of Winston Salem - Questions

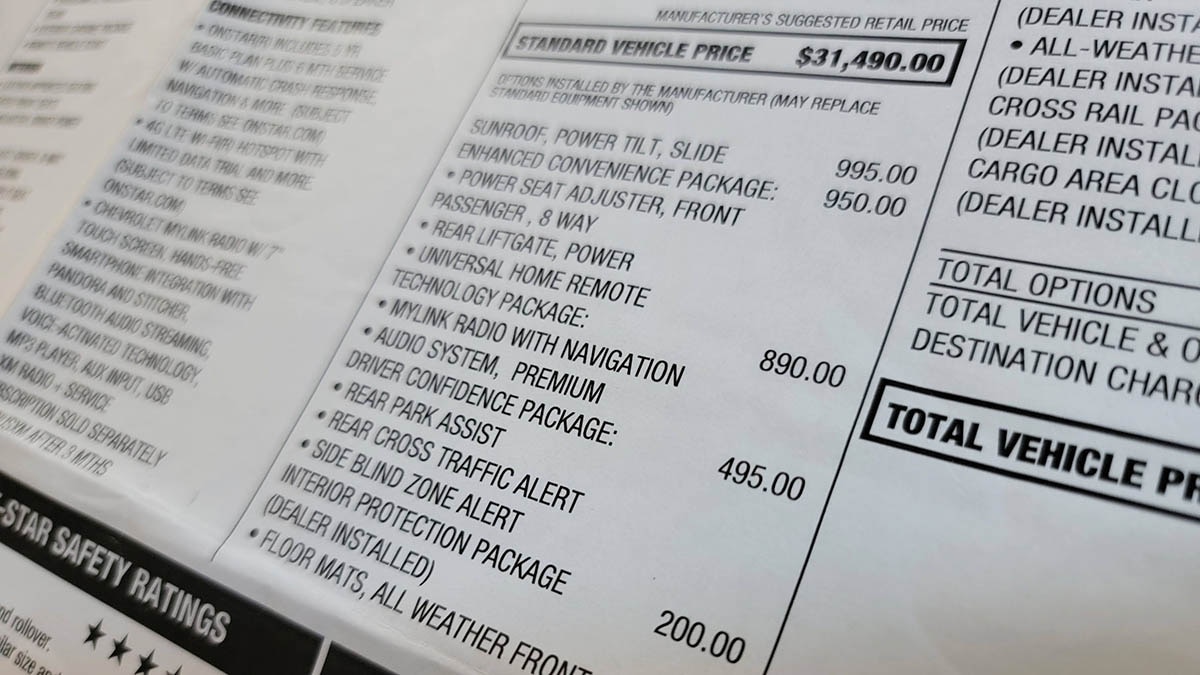

Many individuals watch buying a cars and truck as one deal. It's not, and dealers know this. It's really 3 deals rolled right into one: the new cars and truck price, the trade-in value and the funding. All 3 are methods for the supplier to generate income meaning all 3 are areas you can conserve.

You can shop your trade-in at numerous suppliers to get the best rate. And coming in with common price for the car you want will certainly assist you keep the salesperson honest. The sales or money team might throw away an excellent month-to-month settlement one that you moderately can get approved for.

Sometimes, the supplier may have factored in a huge deposit or extended the term of the car lending to 72 or 84 months. Exactly how to prevent: Concentrate on the price of the car instead of the regular monthly repayment. Never ever respond to the inquiry, "Just how much can you pay every month?" Stick to claiming, "I can afford to pay X dollars for the auto." You should likewise make sure that any kind of price discussed is the complete price of the lorry before your trade-in or down settlement is used.

Indicators on Modern Chevrolet Of Winston Salem You Should Know

Verify that you have actually been accepted for the funding your supplier uses, and just leave the display room with contracts in hand that consist of every one of your funding specifics. In the occasion your financing really does fail, the supplier should want to call off the sale of the car per a stipulation in your funding contract referred to as the owner's right to cancel.

, covers the difference in between what the cars and truck is worth and the amount you still owe on it. Another preferred, credit history life insurance, will certainly pay the equilibrium of your lending if you pass away before you've been able to repay it.

This offer may not be the ideal one for your pocketbook. A lot of funding motivations are for much shorter terms, and you need an excellent credit scores score. And with temporary lendings, such as 24 or 36 months, repayments on also a reasonably priced automobile can be large.

The Modern Chevrolet Of Winston Salem Statements

State you're taking a look at a $20,000 auto and will certainly obtain $4,000 for your trade-in. You can select between 0 percent financing or 3.49 percent with a $2,000 rebate. The regard to the lending is 36 months. At the funding's end, you'll come out ahead by greater than $1,200 if you take the discount and the 3.49 percent funding.

Some warm autos go for price tag and over. Hold your horses and wait: The costs will drop as need decreases. And if you are not familiar with a certain charge or cost being quoted, do not be terrified to request more information. Spot delivery, additionally referred to as area financing, enables you to sign an agreement and drive your auto home prior to the funding is wrapped up.

Confirm that you have been authorized for the funding your dealer offers, and just leave the showroom with agreements in hand that consist of all of your funding specifics. In case your financing actually does fall through, the dealership ought to want to cancel the sale of the vehicle per a clause in your funding agreement called the owner's right to cancel.

Not known Details About Modern Chevrolet Of Winston Salem

One type, space insurance policy, covers the difference in between what the auto deserves and the quantity you still owe basics on it. It's usually just an additional expenditure, yet if you do desire it, gap insurance coverage is normally cheaper when purchased from your routine cars and truck insurance provider. Another favored, debt life insurance policy, will pay the equilibrium of your funding if you pass away prior to you have actually had the ability to settle it.

It won't make feeling for you. It definitely seems appealing 0 percent rate of interest to fund a brand-new car. Nonetheless, this bargain may not be the very best one for your wallet. A lot of financing motivations are for much shorter terms, and you need a stellar credit report. And with short-term lendings, such as 24 or 36 months, settlements on also a moderately valued car can be substantial.

Say you're looking at a $20,000 automobile and will get $4,000 for your trade-in. At the financing's end, you'll come out ahead by more than $1,200 if you take the rebate and the 3.49 percent funding.